Millions of Americans are already excluded from buying a home, and the cost of buying one continues to rise.

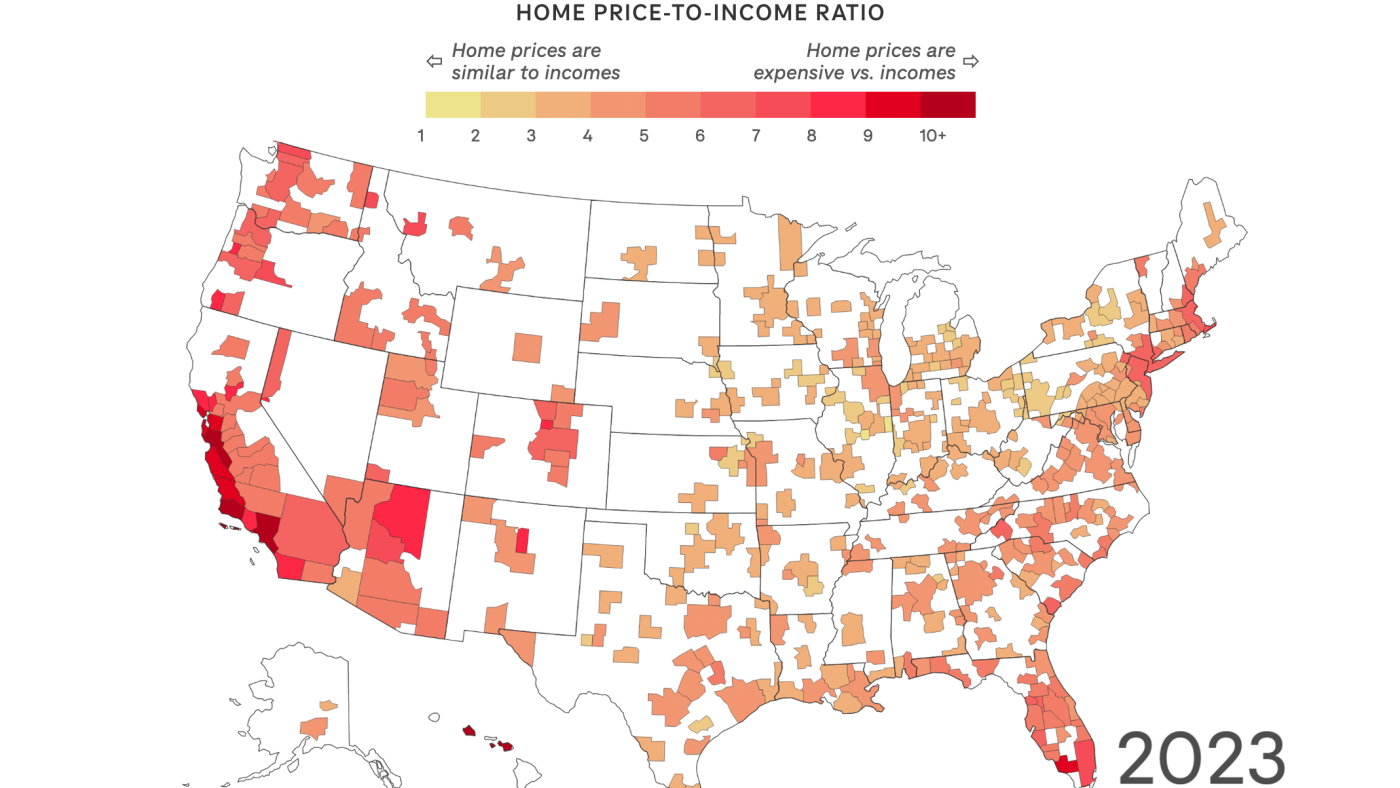

In decades past, it was common to find a home costing roughly three times a buyer’s annual income. But that ratio has been skewed significantly since the COVID-19 pandemic, with home prices up 47% since the start of 2020. Median home sales prices last year were about five times the median household income, according to charts in a newly published report by Harvard’s Joint Center for Housing Studies, and there are signs it could get worse.

The double whammy of high prices and high mortgage rates “has put homeownership out of reach for all but the most advantaged families,” says Daniel McCue, a senior research associate at the center.

The report finds that in nearly half of metro areas, buyers need to fork over $100,000 to afford a median-priced home; in 2021, this was the case in only 11% of markets.

For those looking to buy — as well as current homeowners — rising property taxes and insurance rates are also adding to the financial strain. According to Harvard estimates, “All-in monthly costs of the median-priced home in the US [when adjusted for inflation] are the highest since these data were first collected more than 30 years ago.”

This has made closing racial gaps in home ownership even more difficult. In the first quarter of 2024, the report finds that only 8% of black renters and 13% of Hispanic renters had enough income to afford the monthly payments on a median-priced home.

Meanwhile, with many homeowners reluctant to sell and giving up their lower mortgage rates, home sales have fallen sharply. Last year saw the lowest level of existing home sales in nearly three decades, even lower than after the housing crash of 2008. The U.S. homeownership rate rose just 0.1 percentage point last year, the smallest increase since 2016.

The housing crisis has also helped drive up rental prices

Rising housing costs have left millions of people stuck renting, increasing competition and prices in that market as well. For a record half of US renters, their housing is now unaffordable, Harvard finds. Since 2001, inflation-adjusted rents have risen 10 times faster than renters’ incomes.

Housing experts say the underlying problem for both buyers and renters is a massive housing shortage that has built up over decades and will take years to correct. Single-family construction is on the rise, and some developers are building slightly smaller, lower-cost homes. A boom in multifamily construction has also helped ease rents, especially in places such as Austin, Texas, which saw some of the biggest increases in recent years.

But the authors of the Harvard report say that deadline is unlikely to last.

For one thing, high interest rates and other rising costs — land, labor, insurance — have slowed apartment construction again. And because all that stuff is so expensive, most of what’s being built is at the higher end of the market. Over the past decade, the US has lost more than 6 million rental units under $1,000. For extremely low-income renters, the National Low Income Housing Coalition estimates that for every 100 households, there are only 34 places they can afford.

At the same time, rental demand remains strong, especially as more members of Generation Z move out on their own. Last year, the number of households renting increased by more than half a million, the biggest hit since 2016.

If demand continues to rise while the construction slowdown continues, the Harvard report warns, this “risks triggering another period of rapid rent growth similar to the recent run that has contributed to worsening housing affordability conditions. tenants in history”.